In today's day and age, there are more investment options available than ever before. This can be a great thing, as it gives investors more choices and the potential to grow their wealth in a variety of ways. However, it can also be overwhelming, as it can be difficult to know where to start.

If you're a Singaporean looking to invest, here are a few options to consider besides stocks:

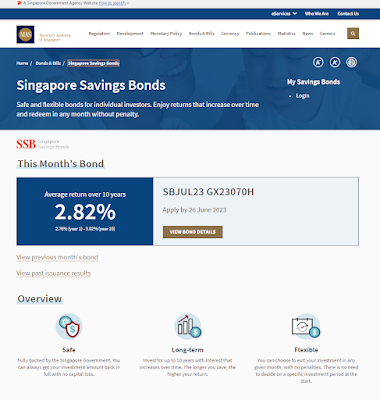

- Singapore Savings Bonds (SSBs)

SSBs are a type of government bond that are issued by the Monetary Authority of Singapore (MAS). They are a popular investment option for Singaporeans because they offer a relatively high interest rate and are considered to be a safe investment.

- Fixed Deposits

Fixed deposits are another type of safe investment that is offered by banks. They typically offer a higher interest rate than savings accounts, but they come with a lock-in period, which means that you cannot withdraw your money for a certain period of time.

- Unit Trusts

Unit trusts are a type of collective investment scheme that allows investors to pool their money together and invest in a variety of assets, such as stocks, bonds, and real estate. Unit trusts are a good option for investors who want to diversify their portfolio and reduce their risk.

- Real Estate Investment Trusts (REITs)

REITs are a type of investment that allows investors to own a share of a real estate portfolio. REITs are a good option for investors who want to invest in real estate but do not want to deal with the hassle of buying and managing properties themselves.

- Peer-to-peer lending

Peer-to-peer lending is a type of lending that allows individuals to lend money to other individuals or businesses directly, without the need for a bank or other financial institution. Peer-to-peer lending can be a good option for investors who want to earn a higher interest rate than they would get from a bank savings account, but it is important to do your research before investing, as there is some risk involved.

- Gold

Gold is a precious metal that has been used as a form of investment for centuries. Gold is a good option for investors who want to diversify their portfolio and reduce their risk. However, it is important to note that the price of gold can be volatile, so you should only invest in gold if you are comfortable with the risk.

- Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. Cryptocurrencies are a new and emerging investment, so it is important to do your research before investing.

These are just a few of the many investment options available to Singaporeans. It is important to do your research and choose the options that are right for you.

Here are some tips for investing:

- Start early. The earlier you start investing, the more time your money has to grow.

- Set goals. What are you saving for? A down payment on a house? Retirement? Once you know your goals, you can make investment decisions that will help you reach them.

- Diversify your portfolio. Don't put all your eggs in one basket. Spread your money across different asset classes, such as stocks, bonds, and real estate. This will help to reduce your risk.

- Rebalance your portfolio regularly. As your goals change and the market fluctuates, you will need to rebalance your portfolio to ensure that it is still aligned with your needs.

- Don't panic sell. The market will go up and down. Don't let short-term fluctuations scare you out of the market. Stay calm and stick to your investment plan.

Investing can be a great way to grow your wealth and reach your financial goals. However, it is important to remember that there is always some risk involved. Do your research and choose the options that are right for you.

Click here to Start investing today with low fees and a user-friendly platform.

No comments:

Post a Comment