|

| source: google |

It has both defensive and offensive income qualities.

Defensive income from running the koufu foodcourt and other food court brands. Nowadays people rarely cook and buying food is so convenient. Everyday need to eat so buy from koufu to eat breakfast, lunch, dinner, tea time, snacks.

Offensive income from selling bubble tea. Drinking bubble tea is not a necessity to me personally. But like coffee, if the users are addicted to it, then is good for the company. And since it is easier to expand with bubble tea shops then foodcourts but with higher risk, it provides offensive income qualities.

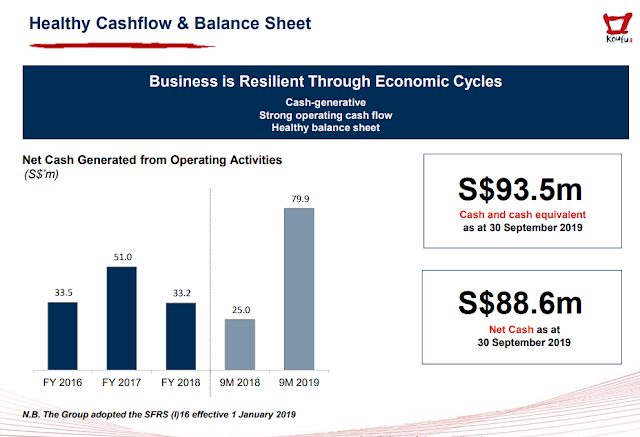

Balance sheet wise, it is net positive cash with enough cash to pay off all debts and still have extra cash.

Cashflow wise is also positive for the past 5 years means business is making money and costs is well managed.

Growth wise, besides Singapore, it is also looking towards Macau that is nearby China. If the foodcourt does well there can expand to a few more places. Bubble tea business with lower setup cost compared to foodcourts, should be able to grow quickly if the demand for the drinks is there. Working via JV with local partners will help to speed up expansion and customer base. Hopefully can work towards reaching the scale of tealive or cbtl.

Recent Financial Results 3Q2019 Presentation Key Slides

We can also expect FY2019 revenue to be 6% more than FY2018

Increase in revenue was mainly due to new outlets and new F&B shops.

With more stores and outlets, more revenue is generated.

Financially, it is cash positive means Koufu has more cash then debts and is able to easily pay off all debts and be debt free.

This would give Koufu the firepower they need if there are opportunities that would grow the business quickly.

The two main source of income stream is outlet & mall management and F&B retail. Under the outlet & mall management business segment, Koufu operates and/or manages food courts, coffee shops, a hawker centre and a commercial mall.

Under the F&B retail business segment, it operates F&B stalls located within its food courts and coffee shops or within third party food courts as well as F&B kiosks, quick-service restaurants and full-service restaurants, amongst others.

To grow the business, Koufu will be expanding into more places in Singapore and Macau and also JV with other companies in Southeast Asia. Hopefully they will have global footprint.

Link to Financial Results 3Q2019 Presentation: http://koufu.listedcompany.com/newsroom/20191104_185356_VL6_V7X0JQJTUH4218LT.3.pdf

Based on the information provided about the business of Koufu, this is why I decided to invest into Koufu for its growth prospect. Let me know if you have ever partonised the foodcourt of Koufu before =) Go ahead to comment on it here and don't forget to subscribe via email or like our Facebook page for the latest updates! Stay tuned for my next blog post as I share about personal finance, investment, lifestyle and company reviews. Also let us know what you would like us to blog about next!

No comments:

Post a Comment